Categories

- Pharmacy

- Nursing

-

MBA

-

BBA

- U.P. State University

- Veer Bahadur Singh Purvanchal University, Jaunpur

- Chaudhary Charan Singh University, Meerut

- Dr. Bhimrao Ambedkar University, Agra

- Chhatrapati Shahu Ji Maharaj University, Kanpur

- Mahatma Jyotiba Phule Rohilkhand University, Bareilly

- Mahatma Gandhi Kashi Vidyapith, Varanasi

- Dr. Ram Manohar Lohia Avadh University, Ayodhya

- Deen Dayal Upadhyaya Gorakhpur University

- Prof. Rajendra Singh (Rajju Bhaiya) University, Prayagraj

- BCA

-

B Ed

- Lucknow University B.Ed Books

- Chaudhary Charan Singh University/Maa Shakambhari University, Saharanpur

- Dr Bhim Rao Ambedkar University, Agra

- Mahatma Gandhi Kashi Vidyapeeth, Varanasi

- Chhatrapati Shahu Ji Maharaj University

- Prof. Rajendra Singh (Rajju Bhaiya) University, Prayagraj (PRSU)

- Mahatma Jyotiba Phule Rohilkhand University(Mjpru), Bareilly

- Dr. Ram Manohar Lohia Avadh University, Ayodhya

- Bundelkhand University, Jhansi

- Deen Dayal Upadhyaya Gorakhpur University

- Veer Bahadur Purvanchal University (VBPU)

- Maharaja Suhel Dev State University ,Azamgarh (MSDSU)

- Raja Mahendra Pratap Singh State University, Aligarh (RMPSSU)

- Barkatullah Vishwavidyalaya (Bhopal)

- Jiwaji University (Gwalior)

- Vikram University (Ujjain)

- Dr. Harisingh Gour University (Sagar)

- Devi Ahilya Vishwavidyalaya (Indore)

- Rani Durgavati Vishwavidyalaya (Jabalpur)

- Awadhesh Pratap Singh University (Rewa)

- Maharaja Chhatrasal Bundelkhand University (Chhatarpur)

- D. EL. ED

- TET

-

B Com

-

B Sc

- B.Sc. U.P. State Universities Common Syllabus NEP

- Veer Bahadur Singh Purvanchal University, Jaunpur

- University of Lucknow

- Chaudhary Charan Singh University, Meerut

- Madhya Pradesh

- Chhatrapati Shahu Ji Maharaj University, Kanpur

- Dr. Bhimrao Ambedkar University, Agra

- Mahatma Gandhi Kashi Vidyapith, Varanasi

- DEEN DAYAL UPADHYAYA GORAKHPUR UNIVERSITY

- Prof. Rajendra Singh (Rajju Bhaiya) University, Prayagraj

- Dr. Ram Manohar Lohia Avadh University, Ayodhya

- Mahatma Jyotiba Phule Rohilkhand University, Bareilly

- Uttarakhand State Universities

- B.Sc. Bihar Universities Common Syllabus NEP

- University of Rajasthan (Jaipur)

- Haryana

-

B A

- B.A. Of U.P. State Universities Common Syllabus NEP

- Veer Bahadur Singh Purvanchal University, Jaunpur

- University of Lucknow

- Chaudhary Charan Singh University, Meerut

- Chhatrapati Shahu Ji Maharaj University, Kanpur

- Dr. Bhimrao Ambedkar University, Agra

- Mahatma Gandhi Kashi Vidyapith, Varanasi

- Deen Dayal Upadhyaya Gorakhpur University

- Prof. Rajendra Singh (Rajju Bhaiya) University, Prayagraj

- Dr. Ram Manohar Lohia Avadh University, Ayodhya

- Mahatma Jyotiba Phule Rohilkhand University, Bareilly

- Madhya Pradesh

- Uttarakhand

- Bihar

- University of Rajasthan (Jaipur Syllabus as Per NEP2020)

- Haryana NEP-2020

- B Tech

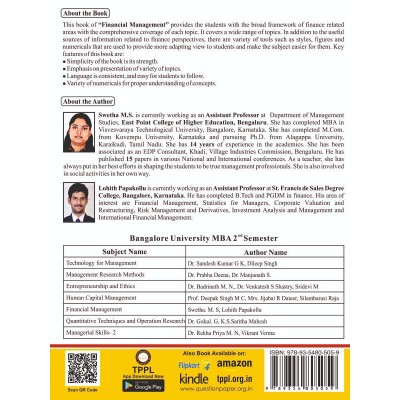

Financial Management | MBA 2nd Sem | Bangalore University

Buy Latest Financial Management Book for Mba 2nd Semester in English language specially designed for BU ( Bangalore University, Karnataka) By Thakur publication.

ISBN - 978-93-5163-448-5

Authors : Sweta M.S. , Lohita Papakollu

₹235.00

Tax excluded

Buy Latest Financial Management Book for Mba 2nd Semester in English language specially designed for BU ( Bangalore University, Karnataka) By Thakur publication.

ISBN - 978-93-5163-448-5

Authors : Sweta M.S. , Lohita Papakollu

Syllabus

Course Code: 2.5

FINANCIAL MANAGEMENT

Module 1: Introduction to Financial Management 6 Hours

Concept of Financial Management - Meaning and Definitions, Scope of Financial Management, Finance Functions, Financial Goals of a Firm, Agency Problem, Emerging Role of Finance Manager in India.

Module 2: Time Value of Money 6 Hours

Compounding, Continuous Compounding, Effective Rate of Interest, Discounting – Single Cash Flows & Series of Cash Flows, Annuity – Future Value and Present Value, Present Value of Growing Annuity, Perpetuity – Present Value, Present Value of Growing Perpetuity, Equated Annual Installments.

Module 3: Long-term Financing Decisions (Capital Structure Decisions) 14 Hours

Sources of Funds: Short Term Sources, Long Term Sources, Venture Capital: Features, Stages and Types of Venture Capital. Factors Influencing Capital Structure, Benefit to Owners – EBIT –EPS Analysis, Point of Indifference, Financial Break-Even Point, Cost of Capital- Methods of Computing Cost of Capital: Cost of Equity Capital, Cost of Preferred Capital, Cost of Debt Capital, Cost of Internally Generated Funds, Weighted Average Cost of Capital (Theory and Problems), Leverages-Types and Measurement.

Module 4: Capital Budgeting Decisions 14 Hours

Meaning of Capital Budgeting, Significance, Principles, Capital Budgeting Proposals, Methods of Appraising Proposals. Payback period, ARR, IRR, MIRR, NPV, Profitability Index, APV Method, Capital Rationing.

Module 5: Working Capital Management 14 Hours

Concept of Working Capital, Factors Determining Working Capital, Sources of Working Capital, Estimating Working Capital Needs, Managing Cash, Marketable Securities, Debtors and Inventory.

Module 6: Dividend Decisions 6 Hours

Meaning, Theory of Relevance on Theory of Irrelevance. Walter’s Model, Gordon’s Model (Theory and Problems) Types of Dividends, Bonus Shares, Stock Splits.

BU2023/MBA/2/05

13 Items

New product